Are you having trouble understanding your merchant account? Are you confused about the rates and fees and how you’re being charged?

It’s important to understand the fundamentals of how credit card processing works so that you can choose the right provider for your needs. The provider you choose will handle the details for you. In this article we will discuss the merchant account transaction cycle and how it works as well as interchange and its role in the process.

We’ll also discuss the two main pricing structures and how they compare to each other. Then we will give you some ideas on how to best select a credit card payment processing provider that fits your needs.

the transaction cycle

The customer presents a card to the merchant for purchase of goods or services after the card is swiped or entered into the point of sale software the processor sends out for authorization through the payment processing network. The issuing bank approves or declines the transaction based on funds available. The transaction is then passed through the electronic networks to the processor and the approval code is delivered to the point-of-sale device at the merchant location. The issuing Bank then sends the money to the processing company to reimburse them for the purchase that was made.

This entire procedure takes only a few seconds to complete. The merchant will give the processor a batch of all of their transactions at the end of the day so that money can be deposited into the merchant bank account. Finally, the cardholder will receive a bill for the transaction from the issuing bank.

What is interchange and what role does it play?

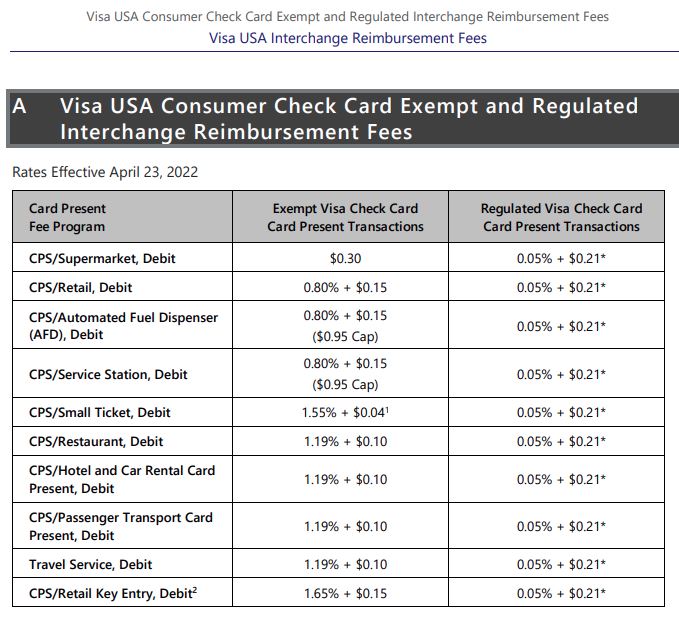

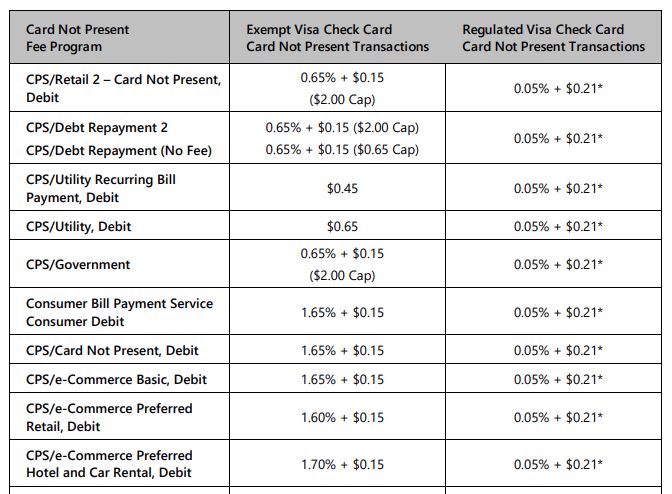

Interchange is a schedule of fees that determine the price for all credit card transactions. There are hundreds of interchange levels and each is comprised of a set of qualification requirements that must be met in order for a transaction to fall into a certain category.

The two main qualification requirements are:

1. How the payment is accepted

Whether its face to face or over the phone for example

2. the type of card that is used

Whether it’s a consumer card or a business card for example.

Individual rate categories are set by Visa and MasterCard and the interchange scheduled fees are published and could potentially change two times per year. This is important to remember since those changes can affect the cost of your merchant account.

There are various rates and categories specified in the published schedules of fees. Again, depending on the eligibility of the card that was given, only one of these rates is ever charged in a single transaction.

Below are images from Visa’s recent published USA interchange reimbursement fees. Click here to see the full report.

Two main pricing models and their components

Most providers will offer the following price structures. Tiered pricing, also known as bundled or bucket pricing, and interchange plus, also known as cost plus or pass-through pricing.

In order to compare these two pricing models let’s first look at how the two pricing structures are related. Interchange costs are at the core of both pricing models. The fees for any given transaction are broken down into two main categories. Interchange

costs along with dues and assessments and processor costs. Dues and assessments are paid to the card networks which is

Visa and MasterCard and are the same for everyone as are interchange costs.

They are absolute and every processing company pays the same amount for interchange dues and assessments, period.

They cannot be changed or discounted for special situations or for any reason. Whether you’re a fortune 500 company

processing billions of dollars each year, or a hobby business with just a couple thousand dollars in volume, you pay the

same fees.

It’s important to remember that when referring to interchange, you should assume that dues and assessments are included, since we understand that they are the same for everyone.

The processor cost is the one variable that differs from one processor to the next and is the only area open for negotiation in your search for a merchant account provider here’s both pricing models in detail.

tiered pricing

This is also known as bundled or bucket pricing.

Tiered pricing takes hundreds of interchange categories and lumps them into bundles or buckets. The three common tiers are qualified, mid qualified, and non-qualified. The rates increase as you move from qualified to non qualified.

Each of these tiers are set and assigned a specific rate by the processing company and often vary from one provider to the next. What is considered to be a qualified transaction with on provider might fall into a mid qualified transaction with another company.

Tier pricing sorts the hundreds of interchange categories and each tier is priced high enough to cover the average of all of the rates and fees that fall under that tier.

interchange Plus

This is also known as cost plus or pass-through pricing.

Interchange plus pricing passes the actual interchange cost through to you and a small provider charge is charged in addition. Also referred to as provider markup, this fee varies widely based on a variety of factors and can range from five basis points up to one point five percent or even higher.

Interchange costs is at the core of each of these pricing models, and with any pricing model for that matter, and is paid one way or another.

With either pricing model, only a small piece of the total fee is paid to the processor as most of the fee is sent back to the issuing bank. Provider costs are collected for the purpose of paying Network fees and other general business costs such as administrative expenses associated with:

- accountant servicing

- application approval

- costs related to licensing the electronic payment networks

This same calculation is done for each transaction depending on the pricing model that you’re currently paying.

It’s widely assumed that interchange plus pricing is a better pricing model because it’s said to have a true cost or a transparent pricing model but does not necessarily mean that it’s a lower overall cost. Business owners must take into account variables such as average ticket and the number of transactions processed each month in addition to the pricing structure variables discussed above determine whether tier or interchange plus pricing is best for your company.

Merchant account pricing is not one-size-fits-all. What matters the most is the total dollar amount and fees paid for accepting a certain dollar amount of credit card volume.

Our company provides a comprehensive solution that gives you everything you’ll need to set yourself up with a merchant account that works for you.